Hello again Wallfacers!

Here's what had our attention this week:

Wallfacer Labs releases product docs for vaults.fyi

EigenLayer overtakes Aave in TVL

Optimism experiments with metrics-based voting

DeFi lending rates continue to rise

Wallfacer Labs releases docs for vaults.fyi

Story: This week, we were excited to publish docs for vaults.fyi, now available here: docs.vaults.fyi. The docs primarily outline our unique methodology for vaults, providing insights into how we obtain data to extrapolate DeFi yields. As vaults.fyi continues to evolve, expect regular updates to the documentation, including an upcoming section dedicated to our API!

Our Take: The inception of vaults.fyi was driven by our commitment to provide a straightforward and reliable way for users to discover and monitor credible DeFi opportunities. Central to this mission is our unique methodology that relies on blockchain-sourced data, sidestepping the use of external APIs and mitigating the risk of biased information. True to the crypto maxim of “don’t trust, verify,” the publication of our docs solidifies this ethos, ensuring that users have all the tools necessary to make informed decisions.

EigenLayer overtakes Aave in TVL

Story: This week marked a significant milestone for EigenLayer as it ascended to become the second-largest protocol in terms of Total Value Locked (TVL), now trailing only Lido. This surge is a clear indicator of the explosive interest in restaking protocols — pioneered by EigenLayer.

Our Take: The rise of EigenLayer heralds a new chapter in the DeFi narrative, reminiscent of the disruption caused by Lido's rise against conventional lending protocols like Aave. This suggests a trend towards more innovative DeFi products, with restaking protocols like EigenLayer at the forefront. While the rapid ascent of such novel technologies brings excitement, it also necessitates a cautious approach to balance the potential risks. The full impact of restaking protocols on DeFi is still unknown. We are committed to monitoring these trends and giving users the tools they need to stay informed.

Optimism experiments with metrics-based voting

Story: This week, Optimism introduced an experimental governance model known as "impact metric-based voting". Described in detail in a forum post, the model represents a shift from their traditional voting methods. Instead of manually reviewing individual project applications, this new method leverages data to enable community members to prioritize different types of impact and allocate rewards accordingly. The initiative utilizes an "Impact Calculator" prototype, developed by Buidl Guidl, allowing users to select and weigh various impact vectors, essentially customizing how funds are distributed based on the perceived value of different contributions to the Optimism ecosystem.

Our Take: At Wallfacer Labs, we view Optimism's venture into impact metric-based voting as the continuation of their tradition of experimentation. This ongoing evolution showcases the platform's commitment to innovation, a process we've observed with interest, especially as participants in the last round. The shift towards a more data-centric model could mitigate the "popularity contest" aspect inherent in governance, potentially leading to more equitable distributions that align with Optimism's goals. Despite this, the qualitative method has its merits, particularly in bringing to light projects whose impact may not yet be fully captured through metrics alone. This nuanced approach to governance—balancing the quantitative with the qualitative—remains crucial in creating a flourishing ecosystem.

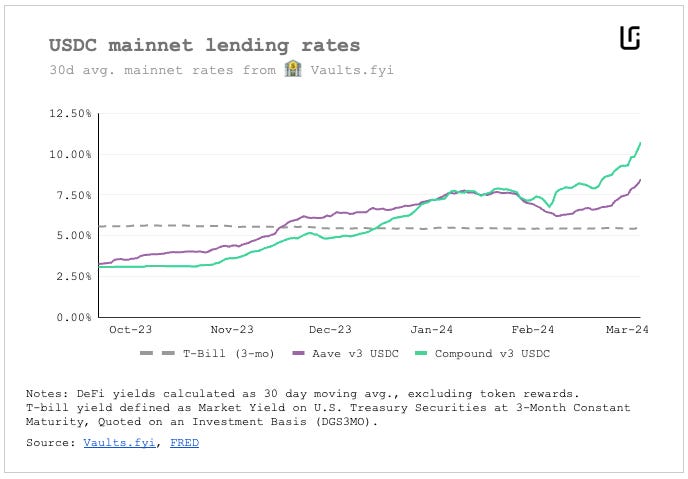

DeFi lending rates continue to rise

Story: Since our previous article highlighting the resurgence of DeFi yields, the trend has only accelerated, with rates climbing to even more impressive heights. Notably, Compound v3 USDC yields on mainnet are now at their highest in over a year, continuing to widen the gap between blue-chip DeFi and T-Bill yields.

Our Take: The continued rise of DeFi yields, especially in blue-chip protocols like Compound v3 and Aave v3 on mainnet, is a testament to DeFi's growing appeal over TradFi options. We believe that as DeFi yields become more attractive, the need for transparent, real-time data and comprehensive analytics becomes paramount. As this trend persists, platforms like vaults.fyi enable savvy lenders to get the most out of DeFi.