Maker Nation’s First State, Spark Protocol

In our first post about crvUSD and GHO, we wrote,

> Will MakerDAO and Curve view GHO as an adversary? Or can GHO, DAI, and crvUSD all grow together in an interwoven network of D3Ms and stableswap pools?

With the pending launch of Spark, we are beginning to see clearer lines of competition between “DeFi Giants”.

Intro

MakerDAO stands at a pivotal moment in its long (by DeFi timelines) history.

Voters recently approved the "Constitution", a significant step towards "The Endgame Plan" which aims to revamp the governance, incentives, and roadmap of the protocol.

Though some criticize the Endgame, we believe the recently announced Spark Protocol showcases its strengths.

In this post, we will dive into the Endgame Plan, Spark Protocol, the concept of "Maker Nation," and how Spark Protocol fits into MakerDAO's long-term vision.

What is the Endgame?

Explaining the Endgame in a few hundred words is challenging, but for readers who may be unfamiliar, let's try.

When MakerDAO's founder Rune Christensen introduced the Endgame Plan in May 2022, he described it as a way to:

create a finite roadmap for MakerDAO that step by step leads to a predetermined, immutable end state many years out in the future, while significantly improving governance dynamics and tapping into the raw power of modern DeFi innovation.

A key aspect of this plan is shifting much of MakerDAO’s complexity away from the "MakerDAO core" and delegating more responsibility to SubDAOs (sometimes called "MetaDAOs").

SubDAOs are smaller, specialized DAOs that maintain strong connections to the MakerDAO core. Crucially, these SubDAOs can also launch their own tokens, creating new incentive opportunities for users and additional potential for builders.

As Rune said recently,

> SubDAOs function as semi-independent specialized divisions within MakerDAO. They have their own governance tokens and governance processes, enabling rapid parallelized growth, specialization, and decision-making. Outsourcing day-to-day complexity to SubDAOs significantly reduces the amount of work and complexity that Maker Governance needs to deal with.

> The primary tasks of SubDAOs include maintaining decentralized frontends, allocating Dai collateral, handling operational efficiency risk, marginal decision-making, and experimenting with innovative products and growth strategies. SubDAOs reuse key governance processes and tools from MakerDAO to streamline their operations.

Spark Protocol

The team behind Spark Protocol "got it," and in October 2022 announced plans to become the first "Cluster" (the stage before officially becoming a "SubDAO") and outlined what would eventually become Spark Protocol.

As hexonaut wrote at the time,

> We want to bring to life new products on top of Maker with the best rates in the market due to the low cost of capital via D3M injection. Our solutions will provide seamless, high-quality user experiences all with best-in-class security practices. Safety and scale is our mission to support the DAI ecosystem.

Four months later in early February, MakerDAO contributors @hexonaut, @Nadia, and @tadeo announced the launch of Phoenix Labs, a blockchain R&D company developing the ‘Spark Protocol’.

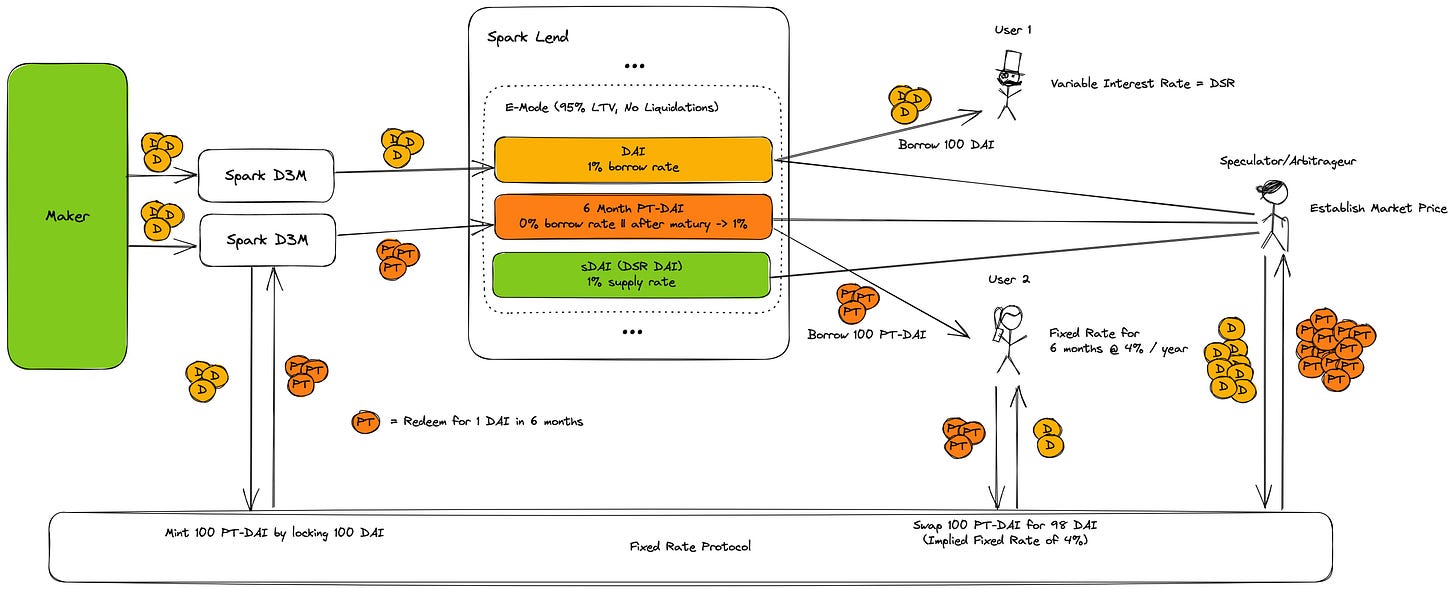

Spark Protocol is an AAVE V3 fork focused on supporting the MakerDAO ecosystem and its products (namely, DAI).

> Phoenix Labs plans to make all code open, owned by MakerDAO, and available for use by other teams under a revenue share agreement using the “Plug and Play” model of the Endgame proposal.

Spark Protocol will grow the DAI supply by treating DAI as a 'first-class citizen' and, in some ways, being more efficient than minting DAI through a CDP (e.g., allowing for collateral hypothecation to offset borrowing costs, as AAVE does currently).

Spark will have its own lending engine and be connected to MakerDAO via a D3M. Spark's goal is not to replace Maker core vaults, but to provide an option for users who want to lend out their collateral for more yield.

Importantly, in our view, a key piece that makes Spark such a viable protocol in DeFi is that it capitalizes on MakerDAO’s core competitive advantage, the lowest cost of capital in all of DeFi.

Because of this structural advantage, SubDAOs like Spark can launch and allow users to borrow DAI just above the Dai Savings Rate (DSR), as stated in the Stability and Liquidity Scope Framework.

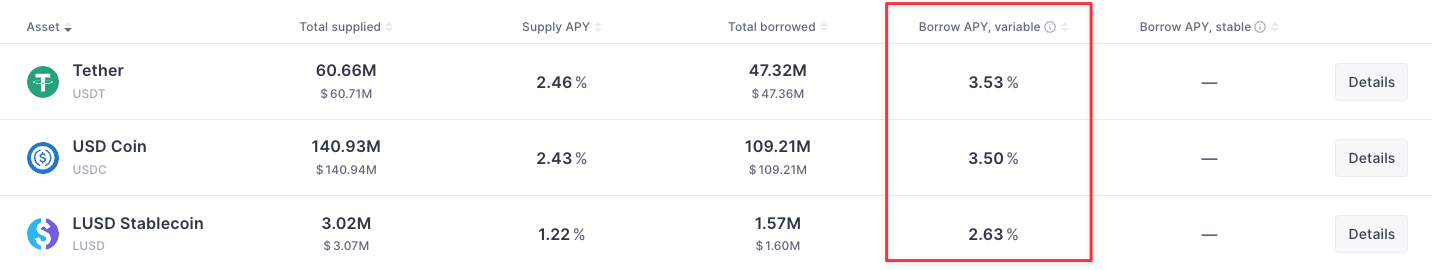

With the DSR currently sitting at 1%, this will be one of the lowest borrow rates in all of DeFi.

Compare this to, for example, the borrow costs for stables on AAVE V3

To understand how this all fits together and grasp the broader vision of what makes SubDAOs and Spark Protocol exciting, let's go back to 2021.

Maker Nation

In July 2021, longtime MakerDAO contributor Mariano.eth posted on the MakerDAO forums with a very humble title, “Question about future products”.

Nearly a year before Rune introduced EtherDAI as a part of the Endgame plan, Mariano suggested that MakerDAO introduce both:

ETH Staking Services by MakerDAO ™

Permissioned / Permissionless Lending Pools by MakerDAO ™

He also introduced the idea of “Maker Nation”,

> All this arises because I feel that we have to use the capital we have to create products that reaffirm MakerDAO as a leader, in pursuit of an ideal called "Maker Nation"

> In this Maker Nation, I would like to see a whole range of Dai-based products where each of them is hierarchically connected to another, always having Dai and Vaults as the beating heart.

With new products including EtherDAI and Spark Protocol on the horizon, we’re beginning to see this vision take shape.

“Crypto is not collab. Crypto is adversarial”

Almost exactly one year after Mariano’s initial post, he revisited the idea of “Maker Nation” in the context of AAVE’s stablecoin, GHO.

He further expands on his argument and ultimately hints at what Spark would announce a few months later:

While the term 'Super App' is overused, Mariano envisioned MakerDAO as a comprehensive suite of financial protocols and applications with all value flowing back to $MKR holders.

These ideas would eventually be codified via the Constitution and Endgame plan, with Spark being a step towards multiple semi-independent brands and protocols building while still connected to Maker Nation.

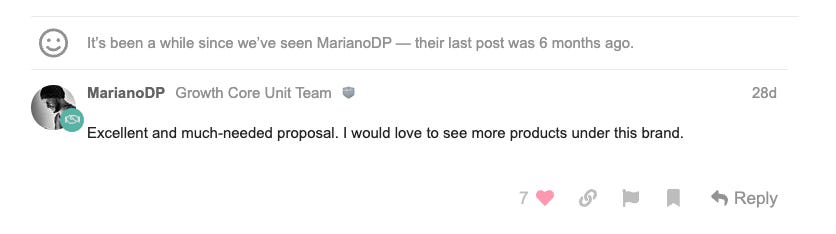

According to Mariano, it seems Spark is on the right track. At the very least, it got him back on the forums!

What makes money in DeFi?

Not explicitly mentioned in Mariano’s post, but something he may have noticed is that few protocols in crypto generate significant protocol revenues (especially when adjusted for token inflation).

The sectors that generate the most revenue (and retain the most earnings*) are

Exchange protocols (Uniswap, Opensea**, Pancakeswap)

Lending protocols (AAVE, Compound, MakerDAO)

Staking protocols (Lido, Rocket Pool)

Derivatives protocols (dYdX, GMX)

*(excluding token rewards)

**not DeFi, but we can still track Opensea revenues on-chain

As Steakhouse Financial highlights in MakerDAO: 2022 Financial Results and Retrospective MakerDAO earned 65mm in revenues in 2022, with 46mm worth of expenses.

MakerDAO is one of the few (if not the only) crypto protocols with positive net earnings (especially when considering token spend). This analysis from Bankless is a bit old but is still directionally accurate.

MakerDAO is unique in that it has generated fees for years without token emissions. This has allowed it to build a significant economic moat, which could enable it to add higher-margin businesses like Spark Protocol.

Can MakerDAO Execute?

The challenge lies in execution, as is often the case with startups. One must ask if MakerDAO can out-execute its peers.

As Luca Prosperi says,

> most OGs have started flexing to steal market share from others. A phase of great convergence has begun, starting around the most successful product to date: stablecoins.

Of the top-5 protocols by TVL today (Lido, MakerDAO, AAVE, Curve, and Uniswap),

One has a stablecoin (MakerDAO)

Two are launching a stablecoin (AAVE, Curve)

Two have not announced anything (Lido, Uniswap)

So we ask:

Does Aave have a better chance at building a successful stablecoin (GHO) vs. Maker building a money market (Spark)?

Does Maker have a better chance of building an LSD (EtherDAI) than Lido has building a stablecoin?

MakerDAO is the OG and, to many, is viewed as the most robust and reliable DeFi protocol. But is it the most innovative or fast-moving? We’ve all seen Degen Spartan’s tweets and it’s fair to make a few observations:

MakerDAO is a complex organism. It is very likely the most complex protocol in all of DeFi.

As an ‘outsider’, interacting with the protocol and making proposals on their forums is challenging.

MakerDAO has its own glossary (DSR, D3M, PSM),

It has strict governance processes,

Maker has a fairly confrontational community,

and lots of differing opinions across delegates, core units, and other stakeholders.

As a result, if you asked “Is it likely MakerDAO could out-execute AAVE or Lido?” most people would probably say no.

It’s not due to a lack of talent that works for the DAO (MakerDAO probably has one of the most talented and dedicated workforces in all of the crypto), but rather the complexity of getting things done within the MakerDAO ecosystem.

But… this is where we begin to see the glimmer of the Endgame plan.

SubDAOs create both new “economics” and incentives for people who want to build with MakerDAO, reducing red tape and providing a sandbox for innovation within Maker.

SubDAOs open up space for talented teams to come in and build something that capitalizes on MakerDAO’s structural advantages. They leverage MakerDAO’s network to get off the ground and incentivize new users with new tokens without diluting $MKR holders.

Conclusion

The Endgame plan is an ambitious attempt to transform MakerDAO into a first-of-its-kind "superprotocol" capable of expanding into higher-margin businesses within DeFi. The success of this strategy will depend on whether MakerDAO can attract teams like Spark (Phoenix Labs) and foster a culture that supports innovation.

Time will tell…