In this post, we will explore two emerging stablecoin designs set to be launched by two of the largest protocols in DeFi — Aave’s GHO and Curve’s crvUSD.

Why does the world need another stablecoin?

Well, as Dirt Roads points out, existing crypto-backed stablecoins have faced challenges scaling due to their relatively low money supply elasticity. This has led to centralized fiat-backed stablecoins USDT, USDC, and BUSD gaining >90% of today’s market share1.

MakerDAO’s DAI is the most successful crypto-backed stablecoin to date, but even it has had to increasingly rely upon centralized fiat-backed stablecoins as collateral in order to achieve scale. As of today, greater than 50% of DAI in circulation is generated from USDC, GUSD, and USDP collateral2.

It has been a challenge for projects to navigate the tradeoffs between price stability, decentralization, and capital efficiency, GHO and crvUSD present two new approaches to navigating the “stablecoin trilemma”.

The GHO and crvUSD launches are significant because both stablecoins have a clear path to becoming two of the largest stablecoins on the market.

They each aim to deliver sustainable, scalable, crypto-backed stablecoins. By improving upon the existing models, they attempt to scale faster than existing stablecoins with less direct reliance on fiat-backed stablecoins and with better collateral backing than past high-flying models (see UST).

Enter GHO and crvUSD: capital-efficient stables with strong networks

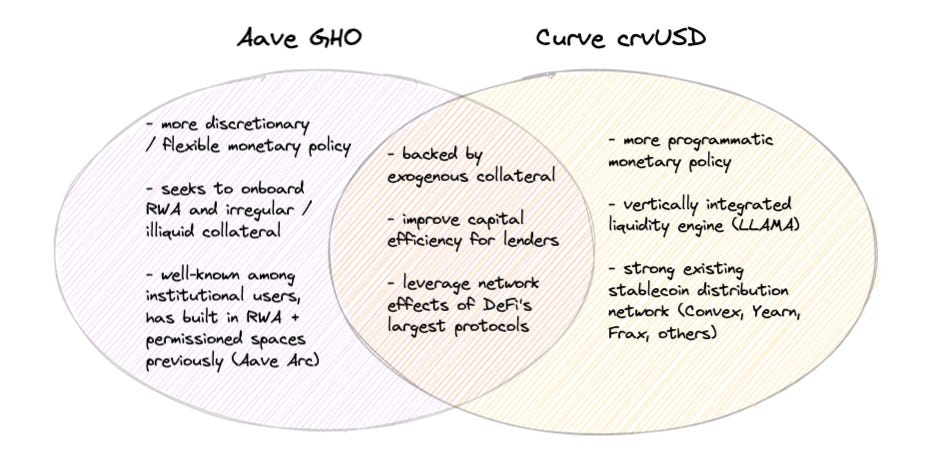

While both GHO and crvUSD aim to tap their respective protocol’s large existing liquidity and distribution networks, they carry significant differences in how they are governed and managed — most notably in how collateral is onboarded and liquidated.

Perhaps the clearest difference we see is that Curve’s crvUSD is more rules-based, or programmatic, while Aave’s GHO is more discretionary.

crvUSD: a highly programmatic stablecoin 🦙

crvUSD collateral is managed by its Lending-Liquidating AMM Algorithm (or “LLAMMA” for short). To pull a simple example of how it works from the crvUSD whitepaper, let’s walk through how crvUSD would handle ETH collateral.3

A user creates a collateralized debt position (CDP) with ETH.

User deposits ETH collateral and mints (“borrows”) crvUSD against this collateral.

At the time crvUSD is minted, the position is loaded into the LLAMMA market maker algorithm with specific price bands assigned to it (similar to Uniswap v3 positions) at which the ETH will be swapped into USD.

As the price of ETH moves down, the position swaps ETH into USD, thus bringing down its LTV ratio. If the ETH price subsequently moves back up through the price bands, then the LLAMA gradually swaps the position’s USD back into ETH through Curve markets, (generating fees for Curve in the process).

The user pays an interest rate set by the controller contract (as a function of crvUSD’s price) to borrow crvUSD. If crvUSD is trading > $1, rates will decrease to incentivize growing supply, and vice-versa.

Following this simple understanding of crvUSD mechanisms, it seems any volatile asset that should possess ample liquidity on Curve’s markets could be viable collateral for crvUSD.

If it were to launch today, strong candidates for crvUSD collateral would be ETH (~$1bn locked in Curve today) and ETH liquid staking derivatives (~$900mm), stablecoins (~$2bn), WBTC (~$100mm), and perhaps FXS (~$100mm). Of course, the launch of crvUSD aims to attract even more capital to Curve. In the same way that market participants use Uniswap v3 to place range-bound orders, they could come to Curve to buy tokens within specific price bands as borrower positions get liquidated. This could prove to be a powerful mechanism to create and expand markets, given that these participants could borrow against their positions.

GHO: a more discretionary monetary policy

In contrast, some key elements within Aave's GHO involve discretionary policy. GHO delegates key responsibilities to Facilitators, entities that implement GHO policy across various strategies as shown in the diagram below.

Facilitators have the ability to onboard new forms of collateral and set parameters (LTV, liquidation thresholds, etc.) at their own discretion. Additionally, interest rate policies on borrowing GHO are also implemented by facilitators. Facilitators will be delegated the ability to mint/burn GHO, with an upper limit on how much GHO can be generated in their “bucket,” to use the GHO whitepaper parlance.

GHO’s flexibility: a key feature that comes with challenges

One could view the facilitator’s high level of discretion as a weakness – it exposes GHO to higher centralization risks and principal-agent conflict – but it also offers benefits… Could GHO’s flexibility actually be the key feature that helps it grow faster to meet demand?

GHO does not necessarily need deep AMM-based liquidity markets to support collateral, as it could potentially rely upon facilitators to manage the intricacies of how collateral gets liquidated. This might help GHO onboard less liquid, more irregular forms of crypto collateral, such as tokenized real-world assets (RWA) and delta-neutral positions.

This flexible implementation could benefit Aave and GHO as it comes across unforeseen scenarios. In Kydland and Prescott’s “Rules Rather Than Discretion: The Inconsistency of Optimal Plans” the economists argue that in a dynamic economic system, the application of a consistent policy selection can result in suboptimal outcomes. Leaving room for discretion could enable policymakers in Aave governance to discover and apply the best policy in a given unforeseen scenario.

On the other hand, it’s worth noting that MakerDAO has quite a bit of discretion in its collateral onboarding governance process today and this process has been known to be complex and tedious. GHO perhaps aims to clearly delegate limited powers (each facilitator’s bucket is capped) to different actors so that it can streamline these sometimes hairy decision-making processes.

In the GHO system, Aave governance will be tasked with onboarding, monitoring, and managing facilitators — all in addition to setting interest rate policies, a stkAAVE discount rate, and numerous other parameters. As GFX Labs points out, navigating such decisions will be no small feat for Aave governance.

One might worry that introducing governance actors with different motives (GHO holders, AAVE tokenholders, and Facilitators) could bring about Aave’s own “Three-Body Problem,” similar to MakerDAO’s trilemma for managing DAI.

crvUSD vertical integration and feedback loops

crvUSD improves the core functionality of the Curve protocol by increasing the amount of trading on its markets. Remember, crvUSD is constantly rebalancing lender positions by trading on its own markets. And as noted in the section above, crvUSD’s capital efficiency could give lenders a reason to bring more capital to Curve.

The positive version of this cycle would be: attract more capital to Curve → generate better liquidity → generate more trading and more fees → attract more capital to Curve (by way of CRV incentives being worth more). As with any virtuous cycle in crypto, it’s worth stating “caveat emptor”. We have learned through past cycles that virtuous cycles can quickly turn into vicious cycles – but still, Curve’s mechanism could provide an asymmetric upside for the system.

GHO also has a self-referencing element to it. Borrowers who hold staked Aave (stkAAVE) can receive a discount on their borrowing costs. This provides additional utility for the AAVE token, but also perhaps another thorny issue for Aave governance.

GHO’s expansion to “real-world assets”, credit, and institutional users

When dealing with RWA, a host of challenges arise with permissioning and how liquidations are managed. By building GHO as a flexible system that can address these challenges, Aave is positioning itself to grow DeFi’s exposure to the wider financial system and to create true credit in crypto (not just overcollateralized borrowing).

Aave has been working to attract institutional users to DeFi for some time, most visibly through its work on Aave Arc and RWA Market. With GHO, Aave aims to give institutions more incentive to tokenize real-world assets (RWA) and tap DeFi for financing. It’s likely that the decision to use “facilitators” in managing RWA collateral is informed by their past experience with Aave Arc markets.

Bringing the “institutions into DeFi” and managing the credit risk of off-chain assets may seem like mythical quests, but remember, we’ve only been chasing this holy grail for a couple of years now… we may be closer than most think and the potential payoff is huge.

Creating demand for GHO and crvUSD

Generating organic demand for a new stablecoin is hard. For a nascent stablecoin without much “lindyness”, it can be tough to get users to hold the coin and to keep trust in the peg.

Luckily for crvUSD, Curve has distribution channels in place that have created demand and secondaries for other Curve stablecoin derivatives. Just look to Convex to observe the demand for bLUSD+LUSD3CRV-f pool tokens, among others. Convex, Frax, Yearn, and other “Curve Wars” participants have built efficient mechanisms to maintain stablecoin pegs, allocate incentives, and aggregate voting power across multiple parties. Curve’s strong distribution network has been built over time, certainly with the help of CRV incentives.

While this is a familiar game for Curve, Aave will be building such a distribution network for GHO from scratch. What will create demand for holding GHO? Will Aave emit tokens to create incentives for users to provide liquidity for GHO markets? Will MakerDAO and Curve view GHO as an adversary? Or can GHO, DAI, and crvUSD all grow together in an interwoven network of D3Ms and stableswap pools?

The ability to easily redeem these stablecoins will attract arbitrageurs to maintain the peg, but it won’t bring demand by itself. Growing demand for stablecoins takes strong network effects and/or token emissions.

So, wen crvUSD / GHO?

Just last week Aave deployed its Ethereum v3 markets, a likely prerequisite for launching GHO, kicking off a slew of “wen GHO?” questions.

On the crvUSD side, we’ll be praying to Satoshi that we wake up to find a new Curve contract deployed by an anon, just as we did back in Aug 2020 with $CRV’s release into the world. (Apparently, Adam Cochran is anxiously awaiting too 😏).

Until then, we at wallfacer labs will be sharing out more research and ideas. We would love to engage further with both the Curve and AAVE teams to see where we can be useful network participants.

Thanks for taking the time to read our first substack post. If you enjoyed it, please give us a follow and say hello at https://twitter.com/wallfacerlabs.

https://defillama.com/stablecoins

https://daistats.com/#/overview

This is a simplistic overview. We anticipate writing a future piece to cover more detail on how crvUSD liquidations operate.